Indo Farm Equipment IPO: GMP, Key Insights, Financial Highlights, and Investment Potential

Investment Opportunities in the Agri Sector

The upcoming IPO will be open for bidding from December 31, 2024 to January 2, 2025, with a price range of ₹204-215 per share. Investors must bid for a minimum lot size of 69 shares, requiring a minimum investment of ₹14,076. The total issue size is ₹260.15 crores.

Indo Farm Equipment Ltd. (IFEL), established in 1994, is a Chandigarh-based manufacturer specializing in tractors, pick-and-carry cranes, and other agricultural machinery. The company offers a diverse range of tractors from 16 HP to 110 HP and cranes with capacities ranging from 9 to 30 tons. Their products are marketed under the brand names “INDO FARM” for tractors and “INDO POWER” for cranes. Additionally, IFEL operates an asset financing business through its wholly-owned subsidiary, Barota Finance Limited, a registered Non-Banking Financial Company (NBFC) specializing in retail financing of tractors.

IFEL’s manufacturing facility is located in Baddi, Himachal Pradesh, covering over 127,840 square meters. This fully integrated setup includes a captive foundry unit and dedicated units for the machining, fabrication, and assembly of both tractors and cranes. The current production capacity is 12,000 tractors and 1,280 cranes annually, with plans to expand crane production by an additional 3,600 units per year to meet growing demand.

The IPO consists of a total of 12,100,000 equity shares, which includes a fresh issue of up to 8,600,000 equity shares and an offer for sale of up to 3,500,000 equity shares by the promoter Ranbir Singh Khadwalia. The face value of each equity share is ₹10 . The bid/offer period is scheduled to open on December 31, 2024 and close on January 02, 2025. The company has undertaken a pre-IPO placement of 1,900,000 Equity Shares at ₹185 per share, which has reduced the size of the fresh issue. The offer will constitute 25.18% of the fully diluted post-offer paid-up equity share capital of the company. As of December 30, 2024, the shares are trading at a premium of approximately ₹75-80, indicating a 35% increase over the upper price band.

The net proceeds from the fresh issue are planned for several key purposes. A significant portion, ₹70.074 crore, is designated for establishing a new, dedicated unit to expand the company’s pick and carry crane manufacturing capacity. This expansion aims to meet the high demand for the company’s cranes and to fully utilise their manufacturing capabilities. Additionally, ₹50 crore is allocated for the repayment or prepayment of certain borrowings, which the company expects will reduce their outstanding debt and improve their debt-to-equity ratio. A further ₹45 crore will be invested in their NBFC subsidiary, Barota Finance Ltd., to increase its capital base and enable it to meet future capital requirements. The remaining net proceeds will be used for general corporate purposes, including strategic initiatives, partnerships, acquisitions, and meeting the company’s operational needs. The amount used for general corporate purposes will not exceed 25% of the gross proceeds of the offer. The company has already utilised ₹33.77 crores from a pre-IPO placement for general corporate purposes.

Financial Insights

Indo Farm Equipment Limited demonstrates a consistent pattern of growth and profitability, although its profit margins remain relatively modest. In fiscal year 2024, the company achieved a revenue of ₹375.23 crore. The company’s profit after tax (PAT) was ₹15.60 crore in the same fiscal year, highlighting its ability to generate profits, though the margins are not particularly high. The company’s PAT margin was 4.16% in 2024, this demonstrates a steady profitability, though it is important to note that the company has seen similar profit margins in previous fiscal years, which indicates consistent operational performance.

The company’s operational efficiency is reflected in its EBITDA of ₹62.52 crore in fiscal year 2024. The company’s return on equity (RoE) was 5.13% and its return on capital employed (RoCE) was 8.96% for the same period. These ratios measure the company’s effectiveness in utilising shareholder investments and capital, respectively. The company’s debt-to-equity ratio stood at 0.01 as of March 31, 2024, indicating that the company has its debt in relation to its equity under control.

The company’s Net Asset Value (NAV) per share was ₹84.43 as of March 31, 2024, which is a measure of the company’s net asset value on a per-share basis. The company’s earnings per share (Basic and Diluted EPS), another key profitability metric, was ₹4.15 in fiscal year 2024.

The company is also aiming to improve its balance sheet further by reducing its debt levels and improving its debt-to-equity ratio, with ₹50 crore from the net proceeds of this issue being allocated to reduce debt. Overall, the company is displaying a consistent and growing financial performance.

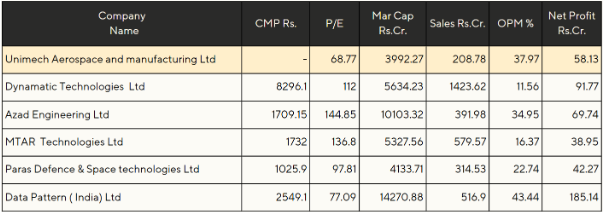

How It Stacks Up Against Competitors

Indo Farm Equipment Ltd., with a P/E ratio of 62.16, is valued higher than peers like Action Construction Equipment (49.25) and Escorts Kubota (31.87), indicating a premium valuation despite its smaller scale. Its sales revenue of ₹360.38 crore and net profit of ₹15.6 crore are significantly lower than those of ACE (₹3,079.9 crore, ₹365.69 crore) and Escorts Kubota (₹9,742.03 crore, ₹1,161.8 crore). However, Indo Farm’s operating profit margin (17.51%) surpasses ACE (14.27%) and Escorts Kubota (12.39%), reflecting efficient operations. While the company shows strong profitability for its size, its smaller market capitalization of ₹1,033.11 crore highlights limited market presence, making it a potential growth play but with valuation concerns.

Opportunities

Indo Farm Equipment Ltd. has opportunities to grow through its planned expansion of pick-and-carry crane manufacturing, supported by an investment of ₹70.07 crore. The company’s in-house NBFC provides financial flexibility, and its international presence, particularly in Africa and Asia, offers scope for market diversification. Additionally, plans to expand its dealer network beyond North India align with the rising demand for mechanized farming solutions and government policies supporting agricultural technology adoption.

Challenges

The company faces challenges such as the potential underutilization of its expanded crane manufacturing capacity if demand does not meet expectations. Its significant reliance on the Indian market exposes it to domestic market fluctuations, including the seasonal nature of agricultural demand tied to monsoon performance, which directly impacts equipment sales. Dependence on financing for tractor sales increases its sensitivity to credit and regulatory risks, while competition from established players like Mahindra & Mahindra and Escorts Kubota adds further pressure to its growth prospects.

Source: Company RHP, Chittorgarh.com, Groww

Note: This article is for informational purposes only and should not be considered as investment advice. All investment decisions should be made in consultation with a qualified financial advisor.